TRX Price Prediction: Assessing the Path to $1 Amid Current Market Dynamics

#TRX

- TRX is testing crucial support near Bollinger Band lower boundary while maintaining bullish MACD momentum

- Positive news flow around network expansion and altcoin rally momentum supports medium-term appreciation potential

- Reaching $1 would require unprecedented growth factors beyond current market conditions

TRX Price Prediction

Technical Analysis: TRX Shows Mixed Signals Near Key Support

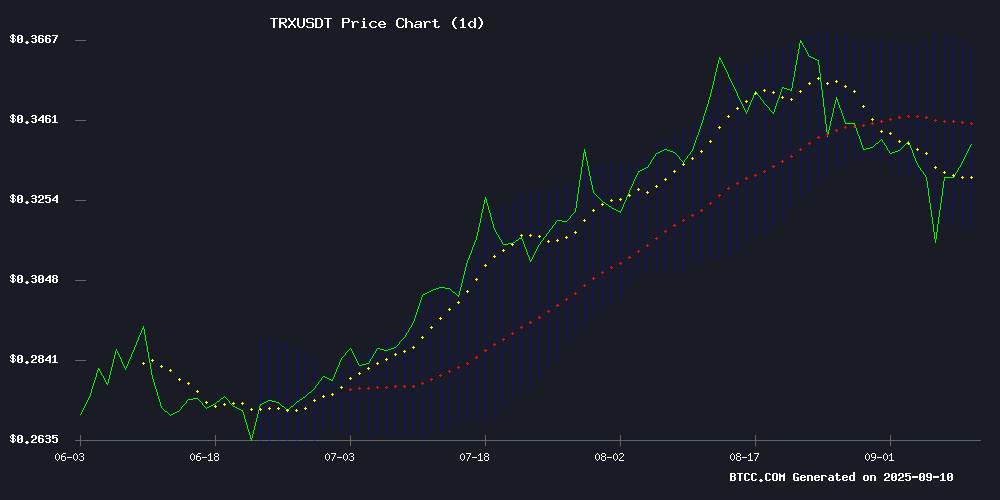

TRX is currently trading at $0.3351, slightly below its 20-day moving average of $0.34109, indicating potential short-term weakness. The MACD reading of 0.013587 remains above the signal line at 0.010809, suggesting underlying bullish momentum despite recent consolidation. According to BTCC financial analyst Mia, 'The price hovering NEAR the Bollinger Band lower boundary at $0.317363 could represent a critical support level. A bounce from this zone might target the middle band at $0.34109 initially.'

Market Sentiment: Positive Fundamentals Amid Consolidation

Recent news flow surrounding TRX presents a generally optimistic outlook despite current price consolidation. Breakout signals pointing toward a potential rally above $0.37 resistance align with strengthening network fundamentals. BTCC financial analyst Mia notes, 'The expansion of USDD stablecoin to ethereum with high-yield incentives, combined with TRON's position in the altcoin rally momentum, creates favorable conditions for medium-term appreciation. However, the failed NPM crypto exploit reminds investors that security risks remain an ongoing concern in the ecosystem.'

Factors Influencing TRX's Price

TRX Breakout Signals Potential Rally Above $0.37 Resistance

Tron (TRX) is demonstrating resilience as it approaches a critical technical juncture near the 1.2x Mayer Multiple. The digital asset's ability to hold long-term support levels has drawn attention, though caution in derivatives markets raises questions about sustained bullish momentum toward the $0.37 resistance level.

The Mayer Multiple, currently at 1.2x, suggests TRX maintains a stable foundation above its 200-day moving average. Historical patterns indicate values above 1.0x typically reduce downside risk while creating conditions for medium-term growth. TRX has consistently defended the $0.317–$0.320 support range, reinforcing its technical floor amid broader market volatility.

Market analysts note the alignment of key support levels with the Mayer Multiple could provide the stability needed for a breakout attempt. 'This convergence creates a strong foundation for Tron,' observed one trader. 'If buyers maintain momentum, we could see a serious test of resistance levels.'

TRON (TRX) Price Tests Long-Term Support as 2025 Outlook Gains Attention

TRON's price approaches a critical juncture, retesting a long-term ascending trendline that has historically served as robust support. The current trading level near $0.33 represents a make-or-break moment for TRX, with market participants eyeing a potential rebound toward the $0.36 resistance zone.

Analysts note the convergence of technical factors, including dynamic curved support and the January high boundary, suggesting accumulation opportunities rather than bearish bets. The asset's ability to hold this level could catalyze the next leg of its upward trajectory.

Failed NPM Crypto Exploit Highlights Ongoing Security Risks

A thwarted attack on Node Package Manager (NPM) libraries this week exposed critical vulnerabilities in crypto infrastructure. Hackers compromised developer accounts via phishing emails, pushing malicious updates to widely used packages like chalk, debug, and strip-ansi. The injected code targeted wallet addresses across Bitcoin, Ethereum, Solana, Tron, and Litecoin networks.

Ledger CTO Charles Guillemet confirmed the attack's failure, noting minimal losses due to coding errors in the exploit. "The phishing campaign originated from a fake NPM support domain," he stated, emphasizing how stolen credentials enabled the breach. The incident underscores systemic risks for platforms relying on automated library updates.

Security analysts warn this near-miss demonstrates the fragility of software dependencies in crypto ecosystems. Exchange and wallet providers face mounting pressure to implement stricter code verification protocols. The event marks another close call in an industry where billions remain perpetually at stake.

TRON (TRX) Price Consolidates at $0.34 as Network Fundamentals Strengthen

TRX trades at $0.34, marking a 1.62% gain over the past 24 hours, as TRON cements its position in the stablecoin ecosystem. The network recently reclaimed its status as the top platform for USDT transactions, outpacing Ethereum with a 67% surge in volume. This shift underscores TRON's growing utility and cost-efficiency for stablecoin transfers.

On-chain momentum builds as Tron Inc. expands its treasury holdings to $220 million following a $110 million investment. While technical indicators remain neutral with an RSI of 49.74, the network's fundamental improvements suggest underlying strength. Market participants watch for potential breakout scenarios as TRON solidifies its infrastructure advantages.

Stablecoins Surpass Bitcoin in 2025 Crypto Betting Trends

The dominance of stablecoins like USDT and USDC in online betting marks a pivotal shift from Bitcoin's volatility to predictable value retention. Pegged to the U.S. dollar, these assets offer bettors price stability—eliminating the risk of sudden value swings that plagued BTC-based wagers.

Transaction efficiency on networks such as TRON and Solana further cements stablecoins' appeal, enabling near-instant deposits and withdrawals critical for real-time betting. While Bitcoin remains a symbol of crypto's speculative potential, its impracticality for consistent stakeholding has driven platforms and users toward dollar-pegged alternatives.

This trend underscores a broader maturation in cryptocurrency adoption, where utility trumps brand recognition. The betting industry's pivot mirrors institutional preferences for asset-backed tokens, signaling a lasting recalibration of payment norms in high-velocity sectors.

Dogecoin Sparks Altcoin Rally as XRP, TRON, and Solana Gain Momentum

Dogecoin has reawakened the altcoin market, leading a surge that includes XRP, TRON, and Solana. The sudden shift has injected new energy into the sector, with traders closely watching whether the rally will sustain or fade.

Meanwhile, XYZVerse enters the meme coin arena with a presale priced at $0.005. Its deflationary mechanics and community incentives position it as a contender in the speculative meme coin space, though its success hinges on post-launch execution and exchange listings.

Justin Sun Expands USDD Stablecoin to Ethereum with High-Yield Incentives

USDD, the decentralized stablecoin pioneered by Justin Sun, has launched on Ethereum amid record growth in the network's stablecoin ecosystem. The move positions USDD to compete in Ethereum's $165 billion stablecoin market, now the dominant hub for tokenized dollars.

The Ethereum deployment introduces a Peg Stability Module enabling 1:1 swaps with USDT and USDC, paired with an aggressive yield program starting at 12% APY. These mechanics aim to bootstrap liquidity as USDD seeks foothold against giants like Tether's $169 billion behemoth.

CertiK-audited smart contracts underpin the overcollateralized algorithmic design, originally developed on TRON. The expansion reflects strategic positioning for the broader $2.5 trillion stablecoin sector, with airdrops and decaying yield incentives deployed to catalyze adoption.

Will TRX Price Hit 1?

Based on current technical indicators and market fundamentals, reaching $1 represents a significant challenge that would require approximately a 200% increase from current levels. While TRX shows promising network development and positive sentiment from recent news, such a move would necessitate substantial market capitalization growth and broader crypto market bullishness. BTCC financial analyst Mia suggests that 'while $1 is not impossible in the long term, investors should focus on nearer-term resistance levels around $0.37-$0.40 as more realistic intermediate targets.'

| Price Level | Required Gain | Probability Assessment |

|---|---|---|

| $0.37 | 10.4% | High (Near-term target) |

| $0.50 | 49.2% | Medium (Medium-term possibility) |

| $1.00 | 198.4% | Low (Long-term aspiration) |